ESG ETF (Conscious Investing)

Looking to learn more about ESG ETF and conscious investing? You’ve found the right page.

In this blog I share my wisdom on exactly this.

ESG ETF funds are an awesome ways to align your money with your values, which will help you grow your wealth while investing for the love of humanity!

I made this blog to explain what these options are and why they might be just what you are looking for.

I am a Certified Financial Planner and Money Mentor. For over 13 years I have been working people to grow their wealth. My name is Stephanie Barnier. Okay my conscious investors, let’s dive into ESG ETF funds.

1) The first thing you need to know about ESG ETF’s is that these funds are diversified with companies that are looking to make an impact.

I love when companies focus their initiatives on people, planet and profit. Because these three things are not just about me, you or them, it is about all of us.

The acronym ESG was coined in 2004 but these concepts have been around for some time stands for:

Environmental: make decisions based on the impact on the environment.

Social: employee, customer & stakeholder relations.

Governance: leadership, pay and shareholder governance.

The acronym ETF means “exchange traded fund” which means these companies are held in a diversified basket or fund. ETF’s trade like a stock which means you can see the price moving up or down during trading hours. ETF’s are economical way to invest as management fees are often low.

2) Why would you want to invest in ESG? What is in it for you and in it for others?

Investing in ESG ETF is a great way to align your money with your personal values. When you choose to aligned important areas of your life with your personal values, everything becomes easier. Including your money. When you approach investing with your values top of mind, you are setting an expectation and intention for your money.

Also as an ESG investor, you join other conscious investors that have set an intention for their money and are using their wealth to vote with their dollars.

What do I mean by vote with your dollars?

Whenever you use or invest money, you are supporting an organization, person or company.

When you invest in ESG ETF’s you are supporting those companies and the shareholders of the companies inside the ETF.

For example, Microsoft is a highly ranked ESG company. When you own shares of MSFT, you are a shareholder of the company along with the CEO, directors and other employees of MSFT. They care about the price of their stock as much as you do. The more folks that buy their stock, the higher the price, which increases your wealth as well as theirs.

This company and shareholders (including you) want to attract more buyers of the stock so they are interested in doing what they say they are going to do for the environment, socially and governance as well as aim to make a profit. I love when companies focus their initiatives on people, planet and profit. Because it is impacts all of us.

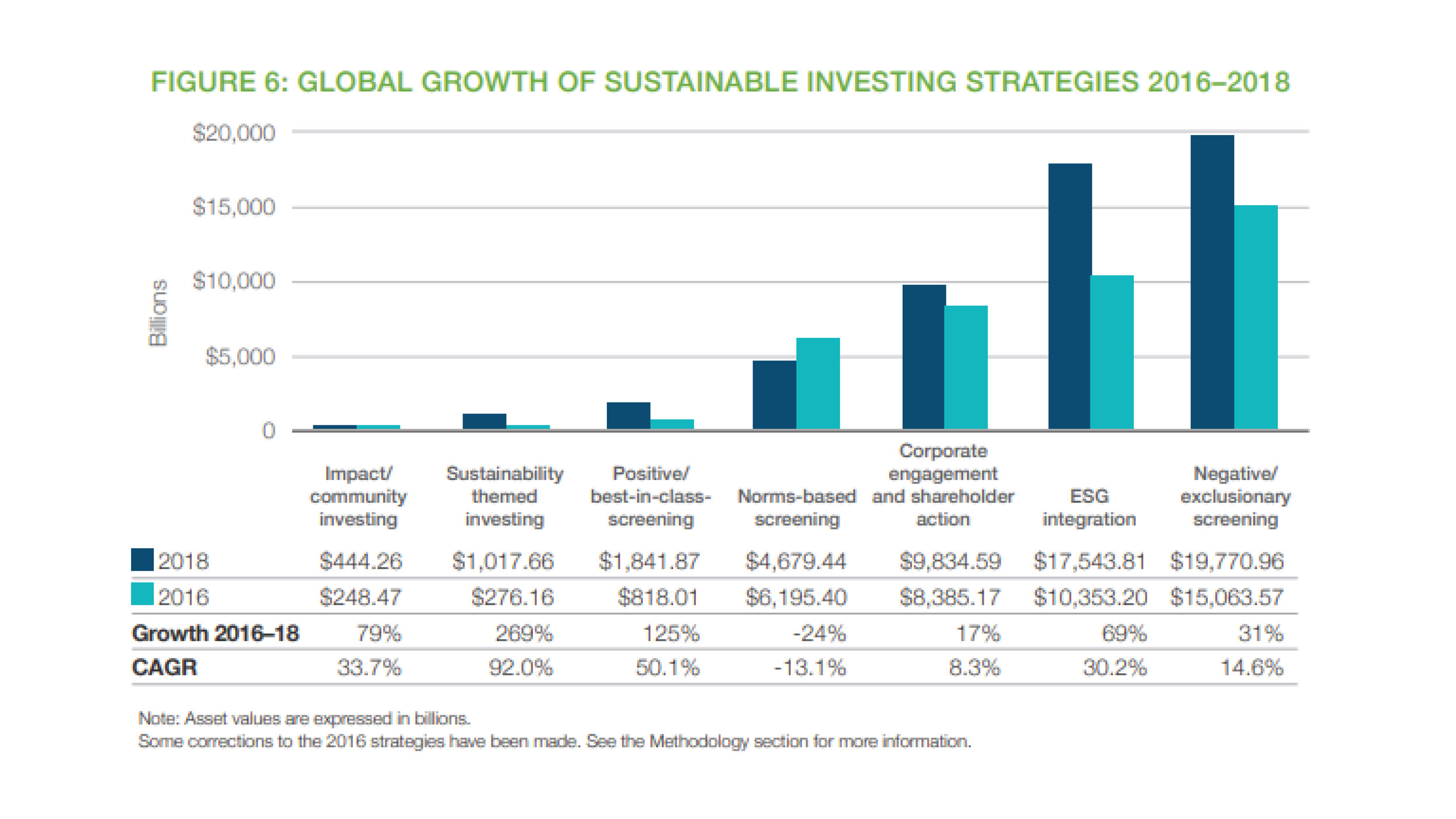

3) Is ESG just a fad or here to stay? Let’s look at the numbers.

ESG investing grew to more than $30 trillion in 2018, according to Global Sustainable Investment Alliance, and that number is set to keep rising as consumer and investors demand more transparency.

Europe has been leading the way with ESG funding with $14Trillion of assets in 2018. US is just behind them with $12trillion in the same year.

According to Bank of America, another $20 trillion is set to flow into ESG funds over the next two decades. This is a lot of money. Just to give you some context for this the entire S&P 500 is worth about $25.6 trillion.

Another reason to people invest ESG is to manage investment risk. For example, if a company doesn’t employ equal pay practices, there could be backlash and a high turnover rate which could the impact the stock performance.

https://www.cnbc.com/2019/12/14/your-complete-guide-to-socially-responsible-investing.html

4) What you need to know to build your wealth with ESG investing is that not every company is going to have a perfect score in all areas of ESG environmental, sustainable and governance.

For example, some companies or funds are going to put a focus on having ethic and gender diversity on their boards so they may not score as high in the environment space but they haven’t completely forgotten about those other factors either.

ESG investing is still an imperfect system, and standards can differ greatly from investor to investor or from fund to fund. But the intention is there from corporations and investors to be better. And isn’t that what we all want, to be better ;-)

Whether you invest ESG, buy from the farmers market or grocery store the key is to have an intention for your money. When you do you have more interest and attention on where it goes. This is a key way to build your wealth.

If you aren’t sure what your personal values are or you feel lost on where to start, we have you covered with this to uncover your personal values. I love simple steps in this guide for anyone to realize their personal values. It is our gift to you for watching this video and taking your next step into prosperity.

If you liked this post subscribe for weekly expert money tips and strategies just for you. Thank you for reading and I’ll talk with you soon.